IRS to take action against thousands of millionaires who haven’t filed taxes

Republican lawmakers unanimously opposed the Inflation Reduction Act of 2022, which increased funding for IRS enforcement of tax laws.

The Internal Revenue Service announced on Feb. 29 that the agency had launched a new initiative to recover taxes from thousands of wealthy people who failed to file their returns from 2017 to 2021. The new effort is being funded by the 2022 Inflation Reduction Act, which President Joe Biden signed into law after it passed despite unanimous opposition on the part of Republicans in Congress.

“Thanks to my Inflation Reduction Act, the IRS is cracking down on 125,000 high-income tax cheats who haven’t filed their taxes since 2017,” Biden wrote in a post on X. “Hardworking Americans do the right thing and file every year. The wealthiest Americans ought to do the same.”

The agency will be sending compliance letters to over 125,000 people who have not filed a return, including more than 25,000 people who earned more than $1 million. The IRS said its records show that the incomes in question were verified after W-2 and 1099 forms for the taxpayers had been submitted but the taxpayers subsequently failed to file annual tax returns.

“The IRS is taking this step to address this most basic form of non-compliance, which includes many who are engaged in tax evasion. This is one of the clearest examples of the need to have a properly funded IRS,” IRS Commissioner Danny Werfel said in a statement.

Before the passage of the Inflation Reduction Act, the agency had said it did not have the funds to identify the high-income taxpayers who had failed to file. According to the IRS, there are possibly hundreds of millions of dollars that have been cumulatively unpaid in these cases.

If a recipient of the IRS notification letters does not respond, the agency said, the cases could proceed to the collections process, auditing, or potential criminal prosecution.

The provision to enhance enforcement of tax laws received vocal opposition from Republicans when Congress was debating the Inflation Reduction Act in 2022.

Republican leaders falsely claimed that the law would be used to hire 87,000 agents to go after small businesses and average-income earners.

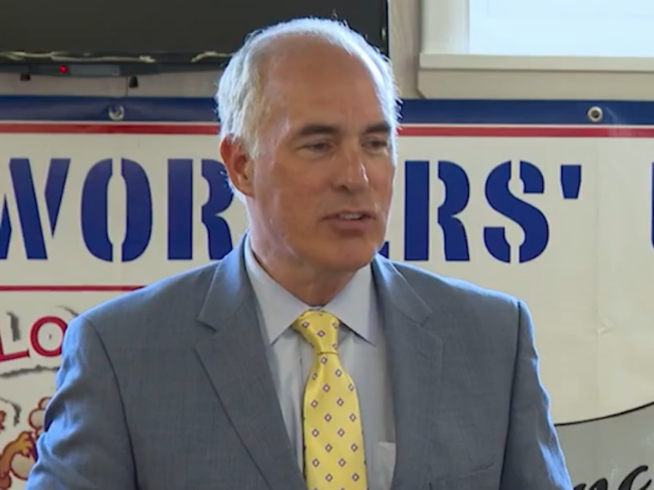

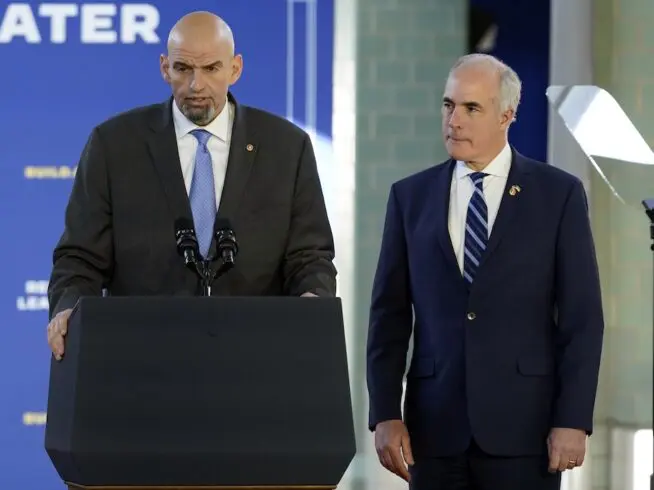

The Democrats in Pennsylvania’s congressional delegation all backed the law, including Sen. Bob Casey. Sen. Pat Toomey, who has since retired, led the vote by Pennsylvania Republicans in Congress against the bill.

“The reconciliation bill coming to the House Floor tomorrow adds $80 billion to the Internal Revenue Service – nearly six times the agency’s current annual budget – and adds 87,000 new IRS enforcement personnel to pursue taxpayers, including the middle class,” Rep. Brian Fitzpatrick wrote in August 2022.

Vice President Kamala Harris cast the tiebreaking vote in the Senate.